Let Buy Car Finance help you find your perfect quality used car today! HP Finance & PCP Finance available.

APPLY FOR CAR FINANCE

Your data is secure

![]() Privacy Policy

Privacy Policy

HOW IT WORKS

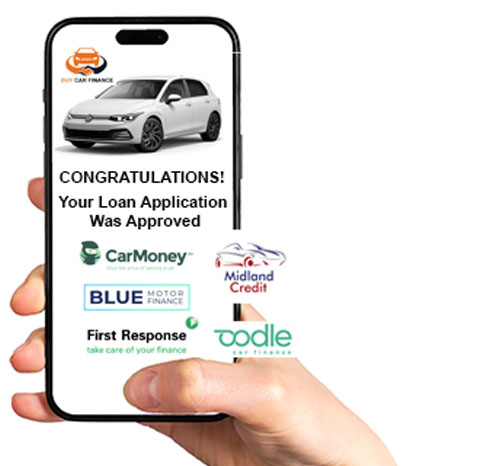

Are you looking for a great car finance deal? At Buy Car Finance, we have you covered. We find the best deals from well respected leading car finance lenders with no hidden fees or charges. Follow these simple steps, and our team will take care of the rest.

Find your perfect quote

Complete our online application form in a matter of minutes. We will then find you the best car finance deal from our chosen panel of lenders.

Approval in principle

A member of our team will be in touch and compare lenders to find the best car finance deal for you. We will help you through the process.

Choose your car

We'll help you find your preferred vehicle and we will help source it for you from Lintlaw Ltd trading as Buy Car Finance. We can also part exchange your old car, or help with any outstanding finance on the vehicle.

What is car finance?

Car finance is the term used when someone wishes to pay for a new car over an agreed period of time, as opposed to paying for the car outright.

The two most common methods of car finance are Hire Purchase (HP) and Personal Contract Purchase (PCP). Lease purchase and personal loan options are also available.

The payments for each of the different car finance types are typically paid monthly and can vary depending on your personal circumstances, either the car you wish to buy, or the contract length you choose.

About Us - Buy Car Finance

Buy Car Finance is your one stop shop to help you find your perfect quality used car!

Our friendly staff will help you choose the best finance option for you! Can we help you? Call 0800 688 9069

Easy Online Application

Simply click the link below to apply for car finance online and we will help you get every little detail right! So you don't have to worry about a thing!

HELP & ADVICE

How Can We Help?

At Buy Car Finance we appreciate that buying a new car on finance can be a daunting process. So many different options to choose from and not really knowing which is best for you. On this page, we have included some helpful links to key information on the website.

Am I eligible for car finance?

At Buy Car Finance, we allow everyone to check whether they are eligible to be approved for finance within a few minutes. Share some small details with us and our lenders will use that information to carry out a soft credit search to give you an answer with the best deals right away.

What if I have bad credit?

If you have a poor credit history, you can still apply for car finance. The company will look at your personal circumstances such as; Your employment status, age, income, loan amount, alongside your credit history. You will then receive your exact interest rates and payments.

Can I part-exchange my car as a deposit?

Yes! You can part-exchange your car as a deposit.

What is APR?

Annual percentage rate (APR) is the interest rate applied to your loan. Predominantly, it is the yearly cost of your borrowing. You will pay this on top of the sum that you have applied for. If you take out a long-term loan, the total amount payable will be more, as you will be paying interest for a longer amount of time.

Can I apply with a provisional license?

Yes, if the provisional is less than 3 years old.

How quick is the process?

Our average transaction takes less than 24 hours to complete from beginning until the end.

I am 17, can I get finance?

Unfortunately, you are legally required to be 18 years or over in order to take out car finance.

What is the difference between HP and PCP?

If you choose HP, you will own the car at the end of your finance term, whereas if you opt for PCP, you can either choose to hand the car back or pay a balloon payment determined by the final purchase price of the car.

Can my partner or other family member drive my car?

If you would like someone else to be able to drive your car, you may be able to add them as a named driver on your car insurance policy.

Do you provide car insurance?

With your permission, we can pass your details on to insurance companies who can provide this for you.

How long is the finance term?

Depending on the age of the car and the lender, between 12-72 months.

What are your minimum requirements to get a quote?

To be eligible for a quote, you need to be at least 18 years old, have a drivers license and earn at least £1000 per month.

Bad credit.

I have bad credit. Can I get car finance?

The simple answer here is YES! At Buy Car Finance, we secure people car finance with bad credit, even if they’ve been refused in the past.

We know a bad credit score can happen to anyone, and should not be the reason people can’t drive a car they really want. A bad credit score can be caused by a CCJ, IVA or even missed payments on other loans and credit agreements.

Whatever your circumstances, our team will work with you to get the best deal available and have you driving away with a new car with payments that suit your budget.

How do I know if my credit is considered ‘Bad’?

Bad credit is defined differently depending on the credit reference agency you use. Below you will see the bandings for the UK’s 3 agencies.

Here are the bandings that Experian, Equifax, and TransUnion currently use to define a poor or very poor credit score:

Experian – 0 – 720 (this is quite a wide banding and the toughest to climb out of)

Equifax 0 – 438 (the tightest banding of the 3)

TransUnion 0 – 566

The great news is that we can still support you with car finance even if you sit in these bands. As well as that, your credit score can be improved over time so you are never stuck with bad credit forever!

Quality Used Cars

Please view a selection of our cars below. Please roll over picture with your mouse or click to see prices and finance information.

Testimonials

- Buy Car Finance helped us to get car finance and our perfect used car! Would Highly Recommend Mrs S McDonald, Customer

- I cannot thank Buy Car Finance enqough for everything they done to help me find my perfect family car! Mr D Taylor, Customer